MEDA has adopted an effort to promote economic development as a valuable investment for Maryland, its counties, and its municipalities.

Bills of Interest

MissionThe primary mission of the Public Policy Committee will be to make MEDA members aware of public policy issues related to jobs and investment at the state and local levels. The Committee will also work with elected and appointed officials to increase their understanding of economic development and the impact of public policy on creating and retaining jobs in Maryland. Finally, the Committee will assist MEDA members with training to become more effective in engaging with elected and appointed officials. |

MEDA and The MEDA Foundation, Inc. do not take a position on any bills and do not lobby. The following links are provided for the purpose of informing our members

Now that the 2025 Legislative Session has concluded, you can explore several key resources to better understand the outcomes. View the 2025 Session Review: Commerce Budget and Legislative Priorities. For updates on fiscal policy, read the message from the Office of the Comptroller: Upcoming Changes to Maryland Taxes. To review important legislation related to economic development, access the Conference Committee Summary on House Bill 350 and House Bill 352.

Notification of Upcoming Tax Changes

MEDA Announces $8.81 Return On Investment From Every Dollar Invested in Economic Development in Maryland

The Maryland Economic Development Association (MEDA) announced the release of updated impact data from its annual study of county economic development offices in Maryland. According to the findings, every dollar invested in county economic development operations over the past three fiscal years has generated an estimated average of $8.81 in state and local tax revenue.

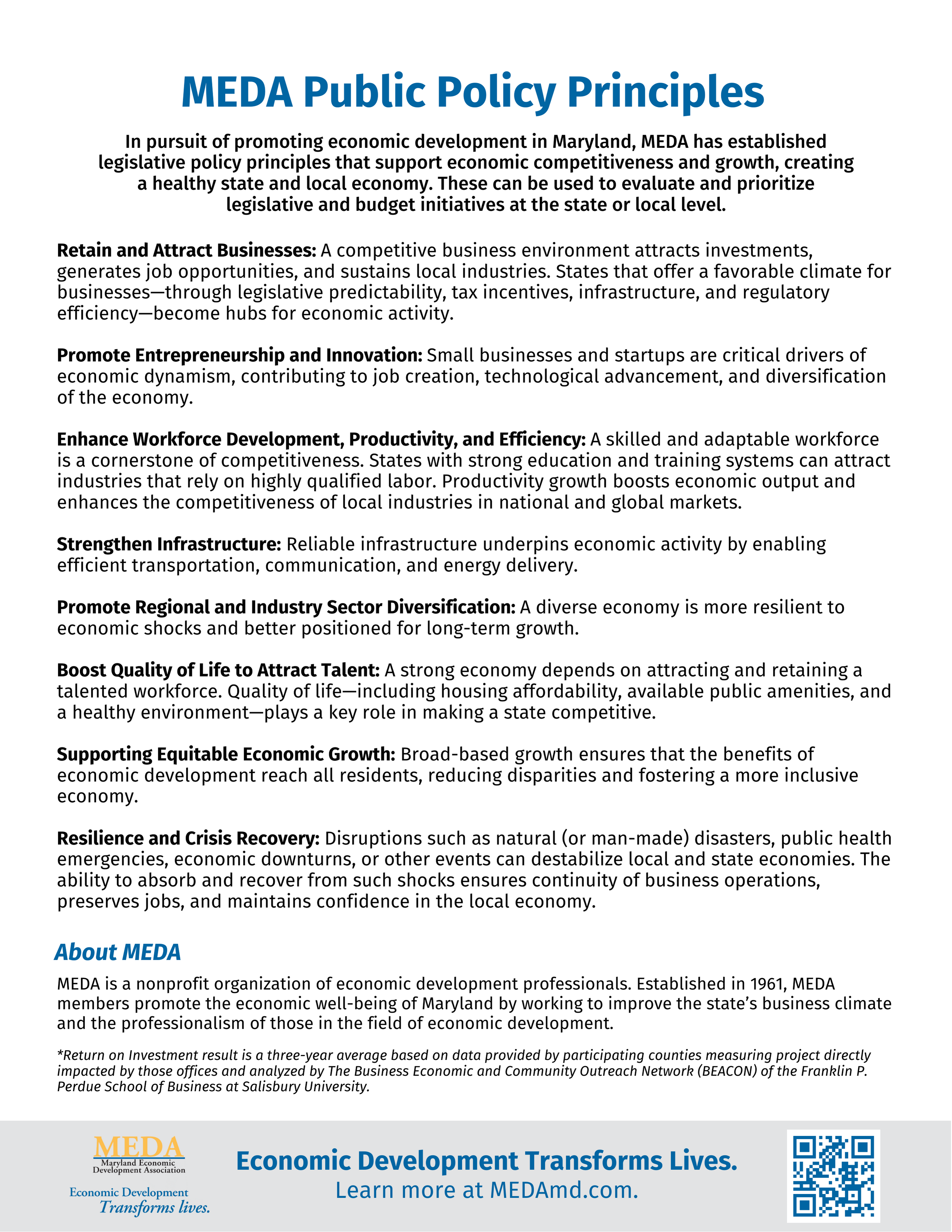

Please click here to download the MEDA Public Policy Awareness Report